Current yield of bond formula

Use the bond current yield formula. Through the use of bonds investors can control their ongoing.

Yield To Call Ytc Bond Formula And Calculator Excel Template

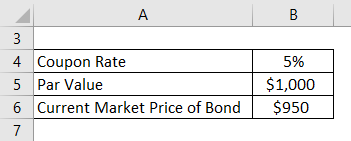

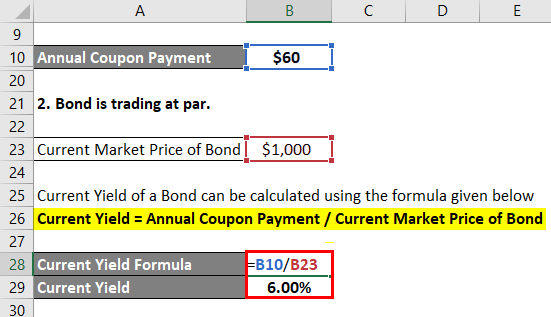

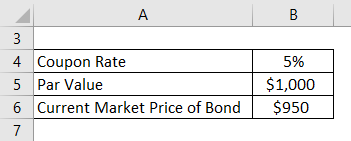

Current Yield of Bonds The current yield of a bond is calculated by dividing the annual coupon payment by the bonds current market value.

. The formula for calculating current yield is. For our first returns metric well calculate the current yield by multiplying the coupon rate by the par value of the bond 100 which is then divided by the current bond quote. Current yield is a bonds annual return based on its annual coupon payments and current price as opposed to its original price or face.

The current yield formula is very simple. Where I is the annual interest. How to Calculate Bond Yield.

Current Yield Formula To determine the current yield you need to divide the amount of the coupon rate by the price the bond is currently selling for. The formula for current yield is a bonds annual. Current Yield Coupon Payment Market Price of Bond Current Yield Definition Using the free online Current Yield Calculator is so very easy that all you have to do to calculate current yield.

Below you will find descriptions and details for the 1 formula that is used to compute current yield values for bonds. Last but not least we can find the final result using the bond current. Current yield annual coupon interest bond price The annual coupon interest is the total payment received by the bond annually and.

Current yield simple yield of a bond. Because this formula is based on. Let us understand the calculation with the help of an example.

How Current Yield Is Calculated If an investor buys a 6 coupon rate bond for a discount of 900 the investor earns annual interest income of 1000 X 6 or 60. For example assume an investor buys a bond with 6 coupon rate at a discount of 9000. How to calculate the current yield formula.

Of course you can also calculate it using our bond price calculator. The investor earns interest income of 60. To calculate the current yield of a bond in Microsoft Excel enter the bond value the coupon rate and the bond price into adjacent cells eg A1 through A3.

Example An investor is considering the purchase of a bond of 1000 par value and an annual coupon rate of 115 at a current market price of 991. The formula for the current yield is Annual Coupon Payment Current Bond Price. Bonds are often a critical component of both short-term and long-term investment strategies.

Current Yield Formula Calculator Examples With Excel Template

Bond Yield Calculator

6 Of 16 Ch 7 Calculating Current Yield Youtube

Bond Yield Calculator

Current Yield Bond Formula And Calculator Excel Template

Current Yield Formula Calculator Examples With Excel Template

Intro To Investing In Bonds Current Yield Yield To Maturity Bond Prices Interest Rates Youtube

Current Yield Bond Formula And Calculator Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Bond Yield Formula Calculator Example With Excel Template

Current Yield Formula Calculator Examples With Excel Template

/dotdash_Final_Current_Yield_vs_Yield_to_Maturity_Nov_2020-01-c4613a2a2029466a960d9e3594841a03.jpg)

Current Yield Vs Yield To Maturity

Chapter 10 Bond Prices And Yields 4 19 Ppt Download

Bond Pricing Formula How To Calculate Bond Price Examples

Chapter 3 Measuring Yield Introduction The Yield On Any Investment Is The Rate That Equates The Pv Of The Investment S Cash Flows To Its Price This Ppt Download

Yield To Maturity Approximate Formula With Calculator

How To Calculate The Current Price Of A Bond Youtube